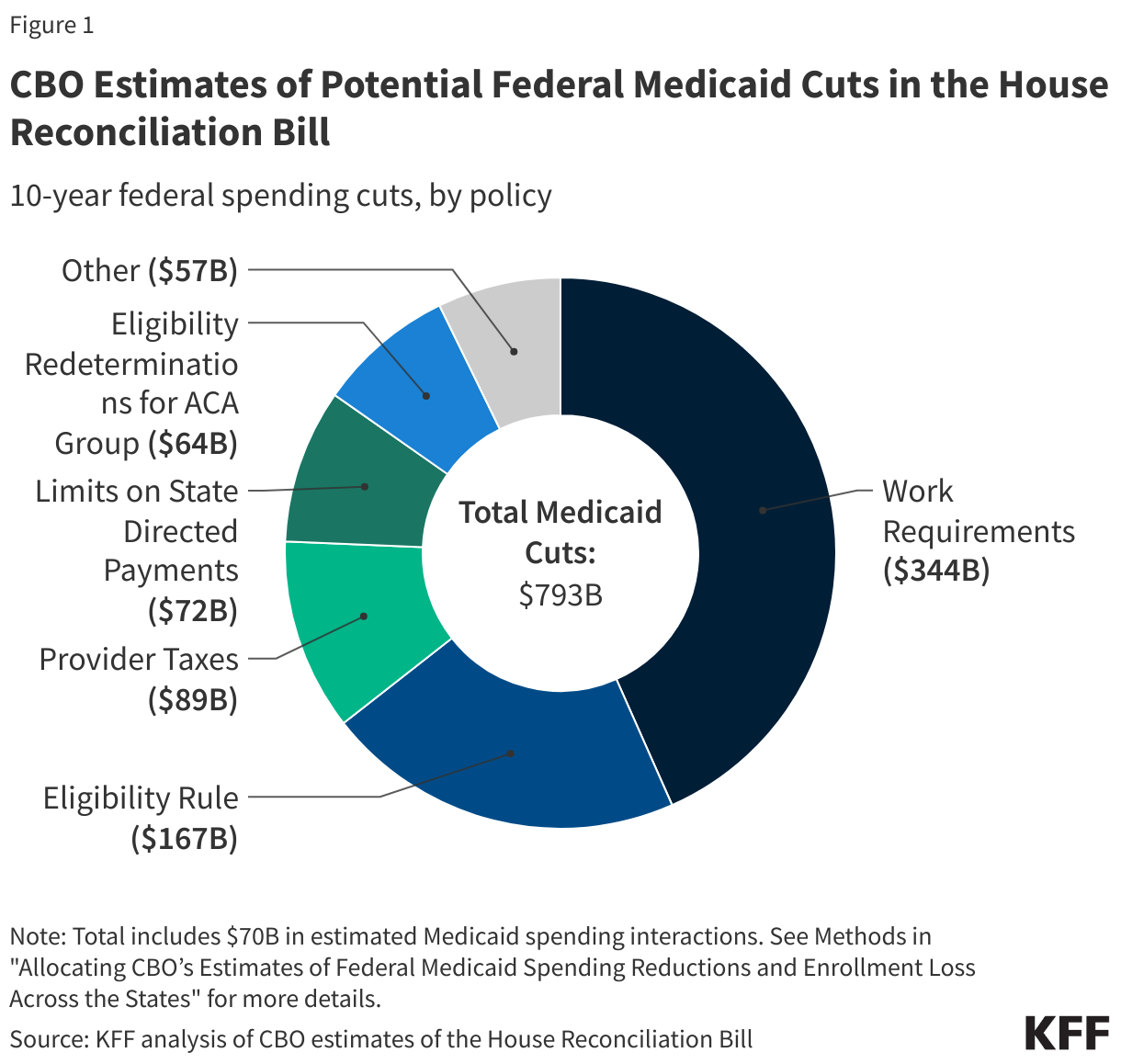

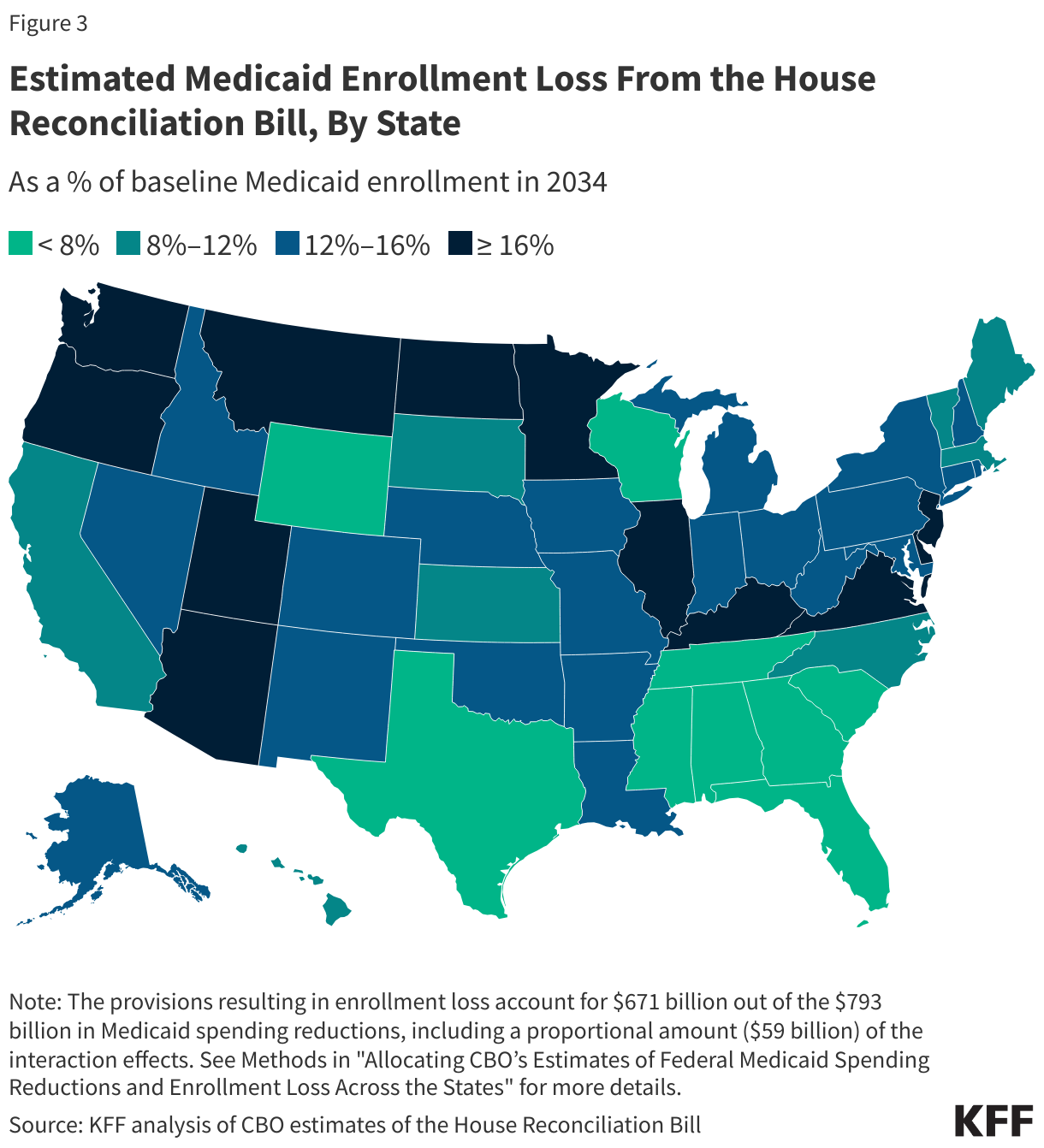

On May 22, the House passed a reconciliation bill, the One Big Beautiful Bill Act. The Congressional Budget Office’s (CBO) latest cost estimate shows that the bill would reduce federal Medicaid spending by $793 billion and that the Medicaid provisions would increase the number of uninsured people by 7.8 million. Previous CBO estimates show that 10.3 million fewer people would be enrolled in Medicaid. Building on prior KFF analysis, this analysis allocates CBO’s federal spending reductions and enrollment losses across the states. The Medicaid reconciliation provisions are numerous and complicated, but the majority of federal savings stem from work requirements for the expansion group, increasing barriers to enrolling in and renewing Medicaid coverage, and limiting states’ ability to raise the state share of Medicaid revenues through provider taxes.

This analysis allocates the CBO’s estimated reduction in federal spending across states based on KFF’s state-level data and where possible, prior modeling work; and shows the federal spending reductions relative to KFF’s projections of federal spending by state under current law. KFF allocates the spending reductions provision-by-provision, pulling in a variety of data sources on which states are estimated to be most affected by each provision (see Methods). The analysis then uses KFF’s state-by-state estimates of reduced federal spending to allocate the reduction in Medicaid enrollment across the states. KFF only includes provisions expected to reduce Medicaid enrollment in that component of the analysis (see Methods).

This analysis does not predict how states will respond to federal policy changes, and anticipating how states will respond to Medicaid changes is a major source of uncertainty in CBO’s cost estimates. Instead of making state-by-state predictions, CBO generates a national figure by estimating the percent of the affected population that lives in states with different anticipated types of policy responses. For example, different states might choose to implement a work requirement with reporting requirements that are easier or harder to comply with. In estimating the costs of the legislation, CBO assumes that in aggregate, states would replace half of reduced federal funds with their own resources in response to provisions that reduce the resources available to states, such as limits on provider taxes. For provisions that reduce enrollment but don’t affect the division of costs between the federal and state governments, such as work requirements, CBO estimates that the federal and state governments would share those savings. However, those assumptions reflect states’ responses as a whole and are likely to vary and may not apply in all states.

To the extent that states’ responses are far different from the overall average response, changes in federal Medicaid spending and Medicaid enrollment will be larger or smaller than what is shown here. States could make further Medicaid cuts, which would result in enrollment loss and spending reductions greater than is estimated here and further reduce states’ Medicaid spending. Alternatively, states could increase their spending on Medicaid to mitigate the effects of federal cuts, which could result in enrollment loss and spending reductions that are smaller than is estimated here. This analysis illustrates the potential variation by showing a range of spending and enrollment effects in each state, varying by plus or minus 25% from the CBO estimated midpoint.

Key Take-Aways

- After accounting for CBO’s estimated interactions, KFF estimates that the House-passed reconciliation bill would reduce federal Medicaid spending by $793 billion. (Without accounting for interactions, the total is $863 billion, see Methods).

- The five biggest sources of Medicaid savings in the House-passed reconciliation bill sum to $736 billion in savings, which is 85% of the uninteracted total, and include:

- Mandating that adults who are eligible for Medicaid through the ACA expansion meet work and reporting requirements ($344 billion),

- Repealing the Biden Administration’s rule simplifying Medicaid eligibility and renewal processes ($167 billion),

- Establishing a moratorium on new or increased provider taxes ($89 billion),

- Revising the payment limit for state directed payments ($72 billion), and

- Increasing the frequency of eligibility redeterminations for the ACA expansion group ($64 billion).

- Provisions that would only apply to states that have adopted the ACA expansion account for $427 billion, roughly half of the total amount of federal spending reductions.

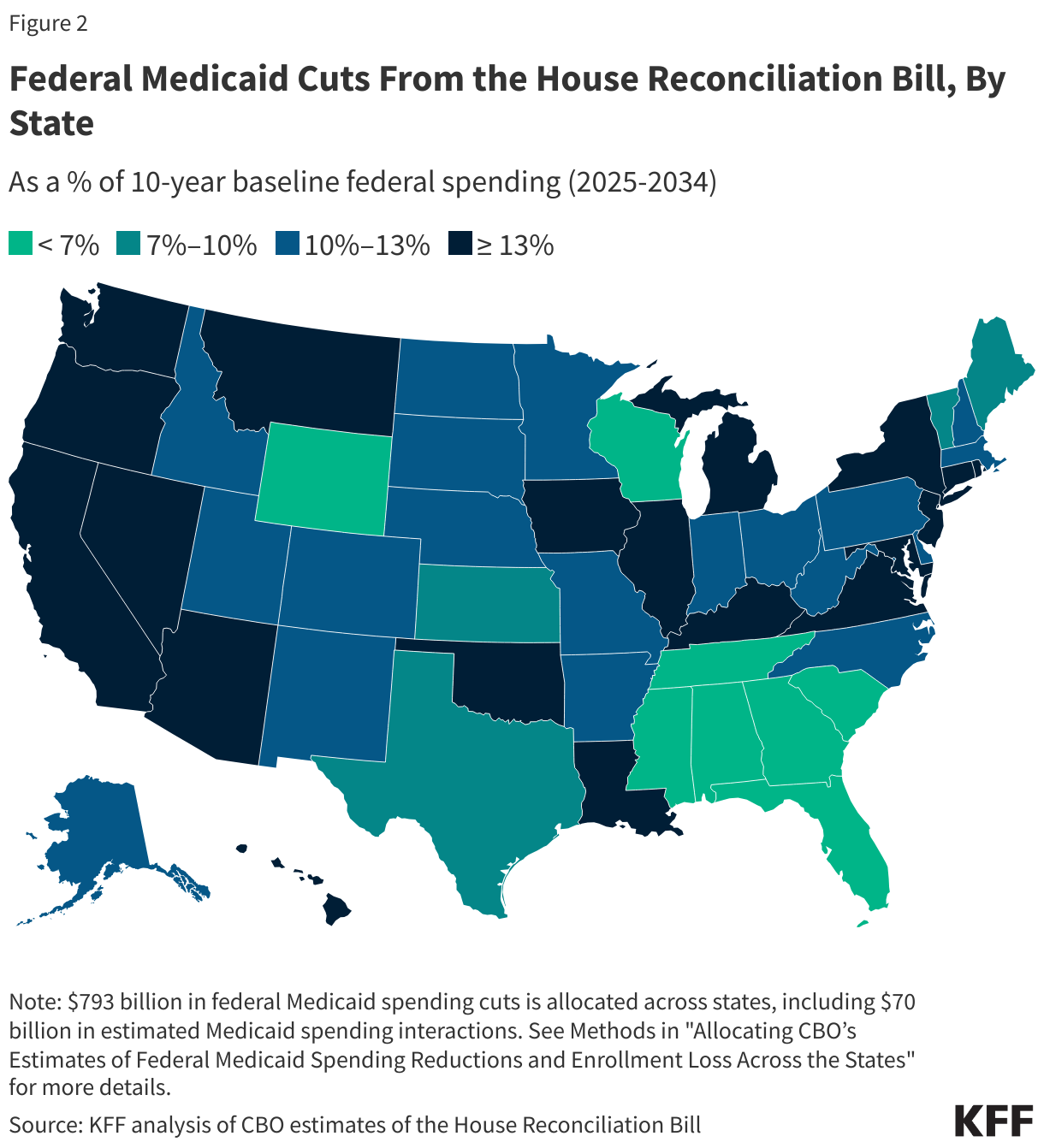

- Federal cuts to states of $793 billion over 10 years would represent 12% of federal spending on Medicaid over the period. By state, the cuts range from 5% in Wyoming and Alabama to 17% in Washington.

- CBO’s estimated 10.3 million loss of Medicaid enrollment in 2034 represents 12% of projected enrollment in that year. The most heavily affected states include Washington and Virginia where Medicaid enrollment could decrease by 26% and 21%, respectively.

Figure 1Figure 1

CBO Estimates of Potential Federal Medicaid Cuts in the House Reconciliation Bill

10-year federal spending cuts, by policy

Note: Total includes $70B in estimated Medicaid spending interactions. See Methods in “Allocating CBO’s Estimates of Federal Medicaid Spending Reductions and Enrollment Loss Across the States” for more details.

Note: $793 billion in federal Medicaid spending cuts is allocated across states, including $70 billion in estimated Medicaid spending interactions. See Methods in “Allocating CBO’s Estimates of Federal Medicaid Spending Reductions and Enrollment Loss Across the States” for more details. Source: KFF analysis of CBO estimates of the House Reconciliation Bill

ote: The provisions resulting in enrollment loss account for $671 billion out of the $793 billion in Medicaid spending reductions, including a proportional amount ($59 billion) of the interaction effects. See Methods in “Allocating CBO’s Estimates of Federal Medicaid Spending Reductions and Enrollment Loss Across the States” for more details. Source: KFF analysis of CBO estimates of the House Reconciliation Bill Methods