Washington D.C. – The Internal Revenue Service collects taxes. But this year it’s handing out cash like an ATM machine. Two IRS officials briefed minority press outlets last week and they were clearly relishing their new role: playing Santa Claus.

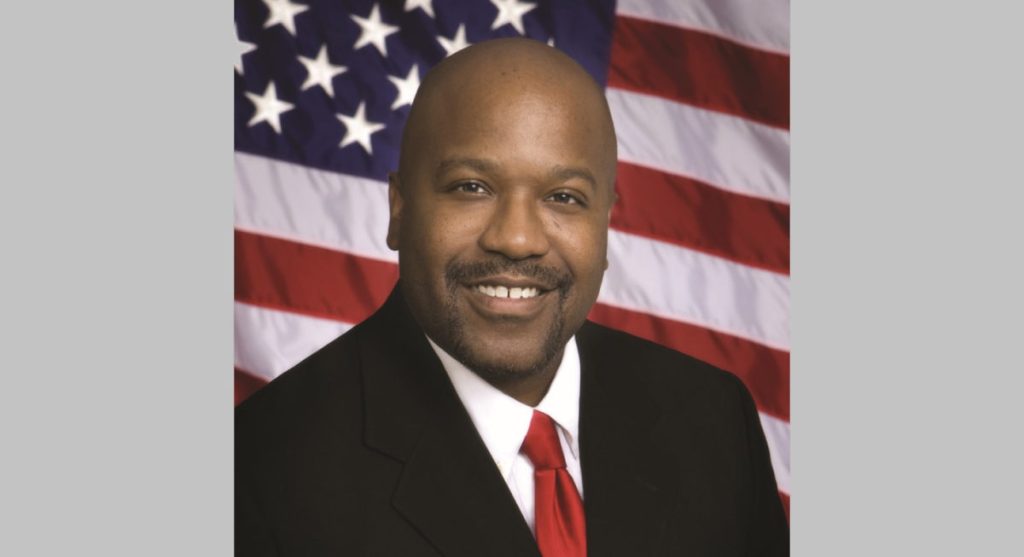

“I’m proud of the work we did to issue more than 160 million of the first round of impact payments in 2020 and another 147 million in the second round, many as early as two days after the legislation was signed,” said IRS commissioner Kenneth Corbin. He is responsible for the administration of tax laws governing individual wage earners in the United States.

Corbin said most people received the full amount of EIP-1 and EIP-2 and do not have to enter anything about them on their 2020 tax returns. “Anyone who may be eligible but hasn’t gotten one or the full amount, may claim it when they file their 2020 return,” he said.

In order to claim your rebate recovery credit you will need the amount of any stimulus check (EIP) you have received. Log into irs.gov to see what Corbin sent you. Go to irs.gov/secureaccess and register for an Online Services account. It takes about 15 minutes to sign up and then you can access most tax tools with the same username and password.

“Tax software will help you figure your recovery rebate credit. The IRS won’t figure it for you but if you make a mistake on line 30 of the tax form, the IRS will enter the correct amount.”

Corbin said the IRS will send you a notice of any changes they make to your tax return. The American Rescue Plan of 2021 authorized a third round of stimulus checks and a number of other tax law changes.

“On the 3rd round, we got the first batch processed the day after the legislation was signed. So far we’ve issued 130 million payments totaling $335 billion.” Most were issued as direct deposit but if the IRS doesn’t have your bank information, they will mail you a check or an EIP card, a prepaid debit card.

Checks have gone out to most taxpayers who filed a Form 1040 in the last two years and to people who used the non-filer tax tool because they owed no taxes. Corbin said that some people like disabled veterans would receive bank deposits or get checks in the mail beginning in mid-April.

The filing deadline has changed this year from April 15 to May 17. You can request an extension until October 15 but if you owe taxes they must be paid by May 17.

Taxpayers can make payments to IRAs, education accounts, and certain health accounts before May 17 and get credit on their 2020 taxes. For tax year 2020 unemployment benefits are not taxable up to $20,400 if married and filing jointly and up to $10,200 for others.

If you are filing electronically, enter the full amount of UEI payments (1099G). The software will make adjustments to your taxable income for you. Corporations and taxpayers who make estimated tax payments quarterly, must file first quarter returns by the old deadline, April 15.

If you claimed a child tax credit in 2019 or 2020, you can get an advance on the child tax credit for 2021. For this year’s taxes, Corbin advises taxpayers to gather all their documents like W-2s and 1099s for the entire year before filling out their tax return.

“We encourage you to e-file and choose direct deposit. It is the fastest way for your return to be processed and, if you are due a refund, for you to receive it,” Corbin said.

Susan Simon is IRS Director of Customer Assistance, Relationships, and Education. “I have a team of people throughout the IRS who have been working for almost two years making sure we can provide services to taxpayers in so many different languages so they understand what they need to do,” Simon said.

The IRS can communicate with taxpayers in 20 languages and taxpayers can get IRS information sent to them in the language of their choice. Rights of taxpayers are discussed in IRS Pub #1. It is also available in 20 languages. Pub #17 has information for most individuals with families. That is available in 7 languages.

If you need help filling out your tax return, it’s free if you e-file and make less than $72,000/yr. Simon said the IRS has 400 volunteers doing free tax preparation in their community. She said that banks, colleges, AARP, and the United Way also provide free tax prep with more than 90,000 volunteers across the U.S.

Simon said some taxpayers have been hacked by scammers who get their IRS online service account pin number and then file fraudulent claims before people have filed their returns.

Tax scammers are phishing email accounts that end in .edu. Simon said college students get an email with a link to a fake IRS website. Once people use the site, their identity is stolen and scammers file for the victims’ refunds and rebates.

Simon also warned against fake IRS phone calls, too. You might get a call from a number that is in your area code. But the person on the other end who claims to be an IRS agent has disguised the number they are calling from. They may demand payment for overdue taxes. They may threaten to call the police. Or they may pretend to offer you help in filing your 2020 tax return to get a bigger refund and get it quickly. Don’t believe them.

“No, we don’t do that. We never do that,” Simon said. The IRS always writes several times about back taxes and how to get on a payment plan before they contact people by phone. Her advice: if you get such a call, don’t talk. Just hang up.

The Blue Cross Foundation of California and Ethnic Media Services brought this story to you.