Sponsored by JPMorgan Chase & Co.

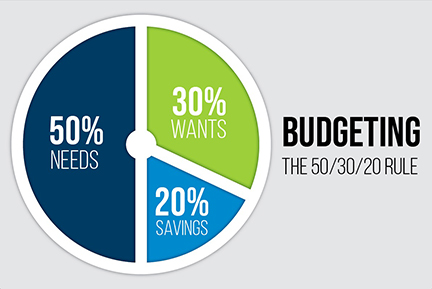

Having a plan for your money is crucial to building a solid financial foundation. If you’re just getting started on your financial journey, the 50-30-20 rule can help you spend and save your money wisely.

By distributing your dollars into three main categories or buckets: needs, wants and savings, the idea is to limit fixed expenses (or needs) to 50% of your after-tax income and discretionary expenses (or wants) to 30%, leaving 20% for savings.

The 50-30-20 rule isn’t a requirement but can be a great starting point to help you take control of your finances, plan your spending and progress towards your financial goals.

50: What are your needs? In this bucket, half of your funds go toward paying expenses you can’t avoid. We all need food, housing and healthcare, and other needs could include transportation, clothing and utilities. Regular debt payments, like monthly credit card minimums and loan payments, would also be considered a need because you have a deadline to pay them each month.

What makes something a “need” versus a “want” depends on your lifestyle. Transportation is typically considered a need, but the type of transportation you select might vary depending on where you live. Having a vehicle may be a legitimate need to get to work and earn money to pay bills, but consider whether you need a luxury car, or if something less expensive would work.

We also need food and clothing, but funds spent on these two categories can flow into the “wants” bucket depending on your choices, such as dining out versus cooking at home or wearing designer gear versus department store basics.

30: What do you want? Everyone should be able to enjoy life’s simple pleasures, and maybe a few extravagant ones as well. Put aside 30% of your funds for these “wants,” which can include entertainment, cable/streaming services, dining out, fitness memberships, travel, hobbies, personal care beyond the basics and a cell phone beyond the basic plan. Overspending can be common in this category since it’s fun to spend money on things we enjoy. Take time to prioritize your most important wants and desires and cut back if you find your spending here going over 30%.

20: Save for the future. This category is all about what you want to do with the money in the future. Do you want to travel the world? Retire early? Help your children pay for college? Once your essential needs and more immediate wants are handled, you can put the rest of your funds — 20% — toward achieving your long-term goals.

If you want to pay off debt more quickly, beyond making your ongoing required payments, you can use money from this bucket to help speed up your plan as well.

Refilling your buckets. Once you’ve given this rule a try for a few months, you might notice your spending and savings habits fall well outside of the 50-30-20 guideline. That’s when it’s time to make some tradeoffs.

Be honest about whether the items you’re putting in the needs category are vital to your life or if you could classify some or all those expenses as a want. It’s OK to spend more on housing if having a more expensive place is important to you; it just means you spend less on a car to balance things out.

If your wants are way beyond 30%, consider scaling back and contributing more to saving for long-term goals. In the same vein, if you don’t have 20% leftover after spending on needs and wants, consider making some adjustments in your other buckets so you have enough for savings.

Tying it all together. The 50-30-20 rule can help you allocate your money to needs, wants and savings and offer insights into where you may need to cut back. Use it to help you on your journey to financial success.

For more saving tips, visit chase.com/personal/financial-goals.

For informational/educational purposes only: Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy.