Economists, the Federal Reserve, and business show pundits are debating questions like “Will we have a recession?” and “How long will it last?” and ‘What should we do about it?

Classic economic theory defines a recession as two successive financial quarters with shrinking Gross Domestic Product (GDP). The last time that happened was in March 2020; it lasted two months. It was the shortest recession on record because of government spending during the COVID-19 pandemic.

The experts predict the next recession will last longer, perhaps eight months. When will it start? The experts don’t know but most predict it will happen soon. It depends on whether hiking the interest rate by the Fed will get inflation under control.

Inflation occurs when the same “basket of goods” costs the consumer more than it used to. The annual inflation rate is currently 8.6%, the largest increase since 1981. For the average family that means a gallon of gas costs $1 more than last year; eggs, milk, and butter cost about $1 more, too.

The average person did not get an 8.6% percent salary raise last year, so paying more at the pump or in the grocery store with the same income means family budgets are tight. As prices increase and inflation rises, they will get even tighter.

When prices and inflation keep rising, the economy slows down. Not only do families suffer but also jobs disappear and social unrest increases like it did in Sri Lanka last week.

After protesting for months against runaway prices and a 54% inflation rate, lack of fuel, and food prices rising 80%, thousands of Sri Lankans stormed the President’s home last week and demanded his resignation. Protestors forced the Prime Minister out in May and the current PM said he will resign and announced that President Gotabaya Rajapaksa will step down on July 13. The country is essentially bankrupt.

Now things aren’t that bad in the U.S. However, the most important function of any administration anywhere is to manage the economy so people can live decently.

Two Views on Managing the Economy

Federal Reserve Chairman Jerome Powell’s approach to reducing inflation is to raise interest rates. According to Investopedia.com, higher interest rates mean higher borrowing costs, so people will eventually start spending less. The demand for goods and services will then drop, which will cause inflation to fall.

Libertarian economist Milton Friedman famously said that the cause of inflation is “too much money chasing too few goods”. A corollary is that if you reduce the supply of money, there is less of it to go around.

The problem with this idea: remember that basket of goods that costs more than it used to? Well, Powell’s and Friedman’s cure is worse than the disease when people don’t have enough money to feed their children, pay their rent, and put gas in their car to go to work. So you already know if your own personal economy is in recession.

Some economists say that the current inflation rate is due to price gouging and corporate profiteering. These economists say raising interest rates hurts businesses, labor, and consumers.

Corporations claim the reasons why their prices are going up is because of unmet shipping demand, supply chain disruptions, and production bottlenecks.

“The 70-year record high in corporate profit margins…..show the mega-corporations are taking advantage of this crisis to pad their profit by passing along more pricing that is not justified by rising input cost alone,” said Rakeen Mabud. She is the chief economist and managing director of policy and research at the Groundwork Collaborative in Washington D.C.

For example, Visa and MasterCard MasterCard control 70% of the credit card market. ”They can’t blame supply chain disruption for profiteering because credit card companies make their money on a fixed percentage fee off of each transaction,” Mabud said.

Inflation would not impact their profits. Both Visa and MasterCard reported this year they would raise their fees. “Visa and MasterCard are using their market power, their control over this market, to raise fees on small business and consumers who have nowhere else to go,” she said.

The Economic Policy Institute (EPI) found nearly 54% of recent inflation can be attributed to corporate profits in contrast to the 11.4% base that corporate profits had on rising pricing between 1979 and 2019.

A recent report from the Roosevelt Institute noted corporate profits hit record highs in 2021 and corporations increased prices at the fastest rate in decades. The report concluded that on average corporations charged consumers 72% more than their inputs costs compared to 56% before the pandemic.

Republicans blame the Democrats for rising inflation. Their standard solution is government social spending should be cut to reduce it. Maybe they believe that but like the “Big Steal” they are either misinformed or delusional.

They blame inflation on rising workers’ wages and investments in the economy like the American Rescue Plan. “Research shows those two things are not factors in what is driving inflation right now,” Mabud said.

An EPI analysis found that wage growth is not “a key magnifier of inflation”. Moody’s chief economist, Mark Zandi, said government spending accounts for .1% of the current 8.6% inflation rate. The war in Ukraine is driving price increases and current inflation more than wage growth which is nearly back to its pre-pandemic level.

Some economists say we need to aggressively raise interest rates, crush wage growth, and raise the unemployment rate to stamp down inflation. Others, like Mabud, suggest turning the Federal Trade Commission and Department of Justice loose on monopolies that abuse their market power. She said that regulators could step up enforcement of laws against price-fixing, Congress could pass higher taxes on big corporations.

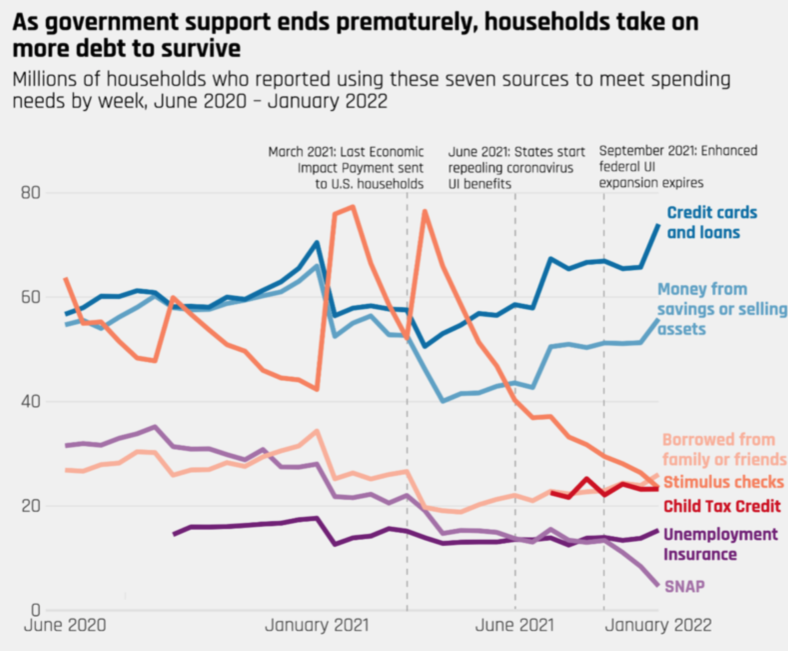

Regarding the safety net, she said people and the economy would be better by increasing government spending on food assistance, housing and child care subsidies, and making reforms to the unemployment insurance system to include more workers.

“Artificially pushing the economy into recession by aggressively raising interest rates would be catastrophic for Black workers and other marginalized workers.

Constraining demand by making people poorer which is exactly what the interest rates would do is deeply flawed policy and dangerous to the economic well-being of marginalized workers in particular,” Mabud said.